Spreadsheets and Excel

A software solution crafted specifically for your industry

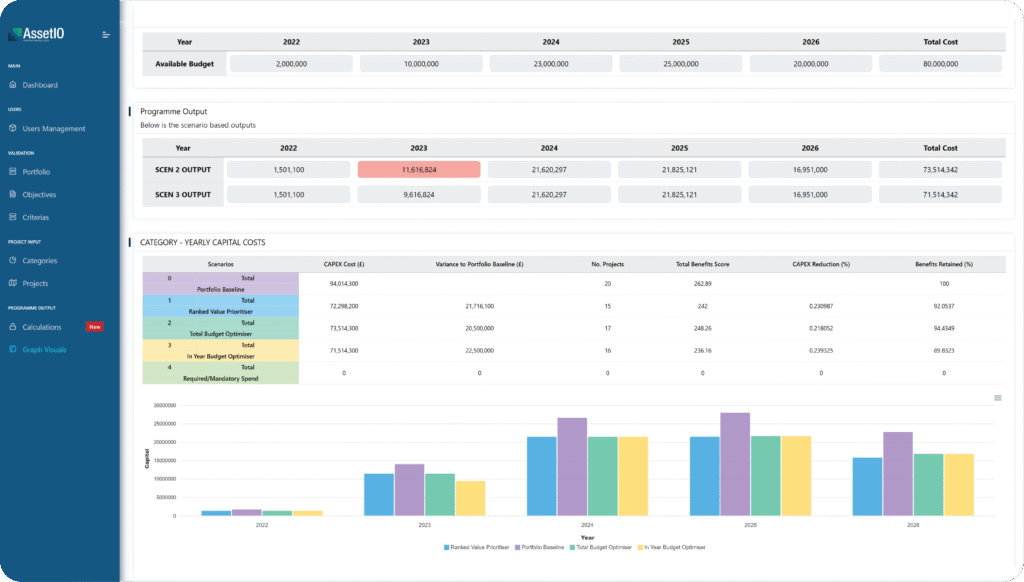

Portfolio Optimization

Ease of Use

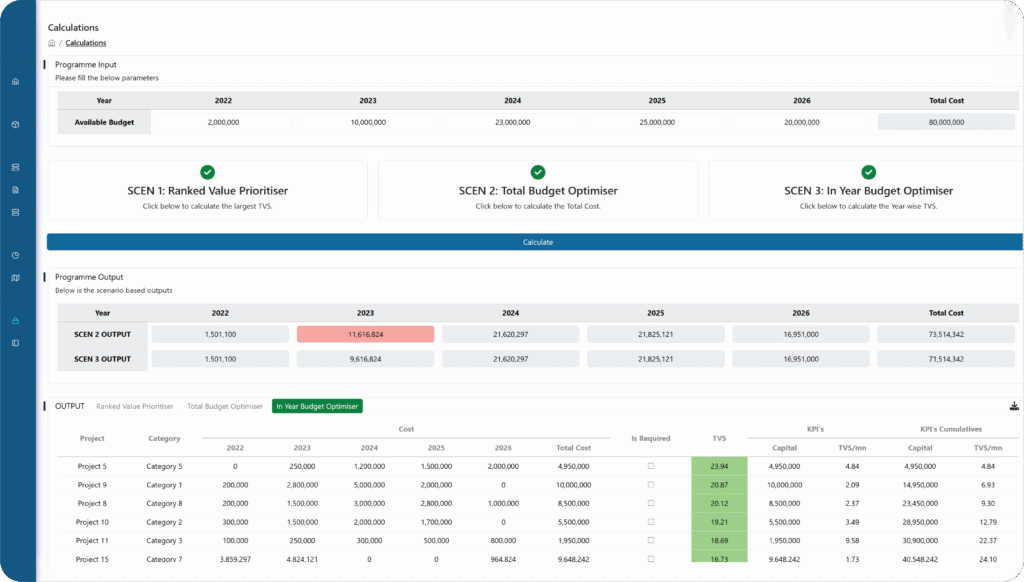

The AssetIO solution evaluates investment options based on multiple criteria, objectives, or values. Instead of prioritizing your investment portfolio based on single parameters, the system aims to provide an optimized solution by considering various criteria. This enables the AssetIO solution to produce multiple scenarios that compare benefits and expenditure constraints.

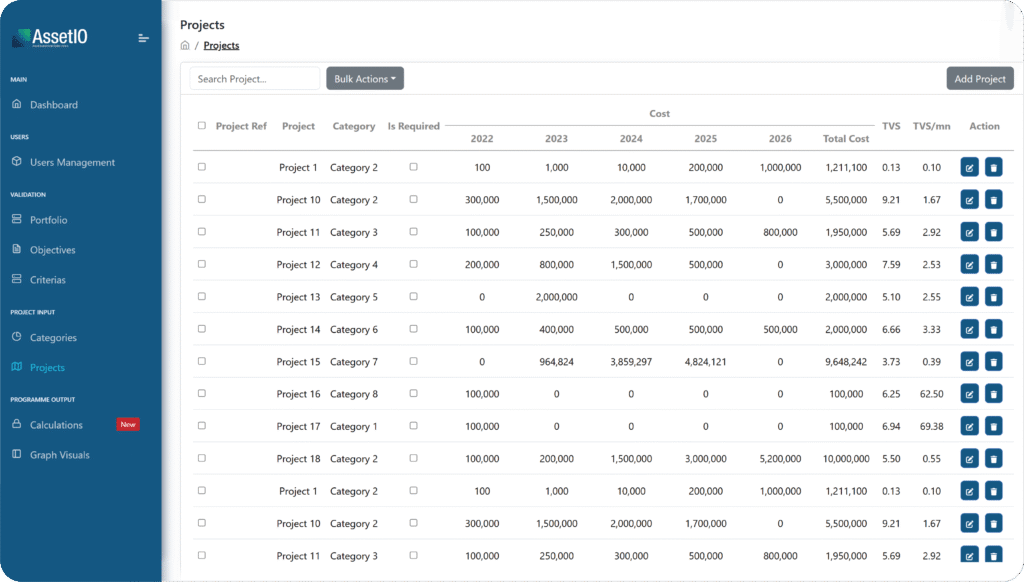

The AssetIO solution is created to function with the minimum possible data, making it easy to use and quick to develop. As a result, it is a compact and user-friendly web-based solution that can be deployed rapidly and adapted easily to meet business requirements.

Decision Support

AssetIO offers an array of features that can help organizations make informed investment decisions by providing valuable insights and recommendations.

By leveraging AssetIO‘s capabilities, infrastructure organizations can improve their decision-making processes, optimize their infrastructure investments, and enhance their overall performance.

Features:

AssetIO offers an array of features that can help organisations make informed investment decision by providing valuable insight and recommendation.

Comprehensive Evaluation:

AssetIO allows decision-makers to consider multiple factors simultaneously, including economic, social, environmental, and technical aspects. This comprehensive approach ensures a more holistic evaluation of alternatives.

Quantitative and Qualitative Integration:

Integrating both quantitative and qualitative information, AssetIO allows decision-makers to combine objective data with subjective outcomes.

Transparency:

The AssetIO process provides a transparent framework for decision-making by explicitly laying out the criteria used for evaluation and the weights assigned to them, fostering understanding and trust among stakeholders.

Regulatory Submission:

The structured framework used by AssetIO and the reporting outputs provide supporting data particularly beneficial for Regulatory Submission and discussion.

Risk Management:

By considering multiple criteria, AssetIO helps assess investment options , optimising the outputs to meet specific needs, enabling the risks associated with different alternatives to be accounted for. This allows decision-makers to make more informed choices and mitigate potential negative impacts.

Stakeholder Engagement:

AssetIO encourages stakeholder involvement by considering diverse perspectives and interests in the decision-making process, leading to more inclusive and satisfactory outcomes.

Consistency and Objectivity:

AssetIO provides a structured and systematic approach to decision-making, reducing the influence of biases and personal preferences. This promotes consistency and objectivity in the evaluation process.

Flexibility:

The configuration options allow decision-makers to customise the value criteria and the specific value measure weightings based on the specific needs of the business, making it adaptable to the business needs and priorities.

Sectors

Serving Key Infrastructure Sectors

Our Business

Asset Management Consulting Limited (AMCL) has been in the business of asset management and asset investment planning for 25 years.

We help our clients across the globe in managing their infrastructure spend and optimizing their capital portfolios

Try a demo!